The Humble Roots :

What started as a recharge services platform at an initial investment of $2 million in 2010 now commands a staggering valuation of $16 billion (Approx ₹1.15 lakh crores). The phenomenal growth story of Paytm is all set to take further strides with the company venturing into the small finance banking space.

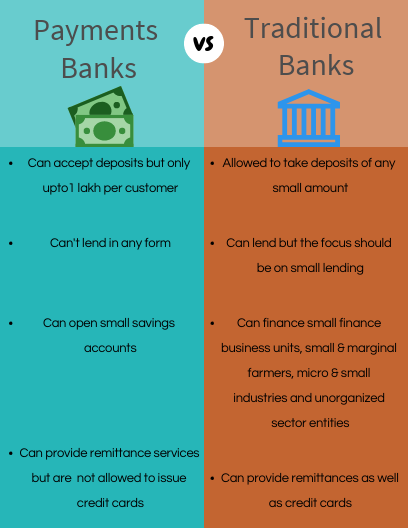

Before we dig deeper let's understand the basic difference between traditional banks and payments bank. The Reserve Bank of India conceptualized Payments banks as a new model for banks. These banks can accept a maximum deposit of ₹1,00,000 per customer. Also, they are not authorized to advance loans or issue credit cards. These banks primarily operate on a small scale and their main objective is to widen the spread of payment & financial services to SME's, MSME's, low income households, migrant labour workforce in secured technology driven environment.

Paytm payments bank was launched in May 2017 under a restricted banking license, at a time when standalone wallet players were loosing their sheen to due to limited uses. Since then, the bank was created a full fledged financial services ecosystem by offering various products such as current accounts, savings accounts, fixed deposits, debit cards, ticket bookings, utility payments, investments in financial instruments, food delivery and much more.

The MD and CEO of the bank, Mr. Satish Gupta expects to double it's savings account base to 100 million by the end of this financial year. The bank has around ₹500 crore in the form of deposits in it's savings accounts. The payments bank entity also houses the e-wallet business which has more than ₹1700 crore of deposits in the financial year ended March, 2019. Paytm's strength lies in it's large user base, strong brand connect and wide customer reach. Paytm payments bank last week achieved the distinction of becoming India's largest issuer of FASTags ( electronic toll payment stickers) equipping over 1.85 million vehicles. The company claims to have a 60% market share in UPI ( United Payments Interface) based merchant payments as of June, 2019. The bank currently has 250 million wallet accounts and expects to end this year with 350 million accounts.

The MD and CEO of the bank, Mr. Satish Gupta expects to double it's savings account base to 100 million by the end of this financial year. The bank has around ₹500 crore in the form of deposits in it's savings accounts. The payments bank entity also houses the e-wallet business which has more than ₹1700 crore of deposits in the financial year ended March, 2019. Paytm's strength lies in it's large user base, strong brand connect and wide customer reach. Paytm payments bank last week achieved the distinction of becoming India's largest issuer of FASTags ( electronic toll payment stickers) equipping over 1.85 million vehicles. The company claims to have a 60% market share in UPI ( United Payments Interface) based merchant payments as of June, 2019. The bank currently has 250 million wallet accounts and expects to end this year with 350 million accounts.

If that's not enough let's not forget Paytm's deep pocketed investors, Alibaba and Softbank who ensure that even if the growth rate moderates, it has enough firepower to retain market leadership.

Caution is the word on the street :

However, not everyone is as exuberant about the fortunes of payments bank as a sustainable business model. In 2015, 11 entities had received licenses to start payment bank operations. However, five of them surrendered their licenses and another Aditya Birla Payments Bank shut it's operations in February last year. The bank had mentioned that " unanticipated" developments in the business landscape made the economic model unviable and unsustainable.

Experts believe the flaw lies in the regulation that payments bank cannot indulge in lending operations. Income from other activities forms a very small percentage of the total profits. The ' other income' component can only be an icing on the cake for banks. Their moot lies in lending. It is not possible for payments banks to survive merely on commission earned on making remittances. Further, even the deposit portfolio is restricted to a meagre figure of a lakh.

Apart from CRR, the banks also have to invest a minimum of 75% of their demand deposits in government securities for maintenance of SLR. A maximum of 25% can be invested in fixed & current deposits of other scheduled banks. These prescriptions do not offer much yield income to the bank. Adding to it, the deposits mobilized by the bank are covered under the deposit scheme and hence the bank has to pay guarantee commissions as well.

Apart from CRR, the banks also have to invest a minimum of 75% of their demand deposits in government securities for maintenance of SLR. A maximum of 25% can be invested in fixed & current deposits of other scheduled banks. These prescriptions do not offer much yield income to the bank. Adding to it, the deposits mobilized by the bank are covered under the deposit scheme and hence the bank has to pay guarantee commissions as well.

The paid-up equity capital for payments banks should not be less than ₹100 crore & the bank should have a leverage ratio of not less than 3%.

Future course of action :

All these restrictions do not leave much on the table for the bank or it's promoters . Hence Paytm payments bank went ahead with it's decision despite all the naysayers & has applied for a small finance banking license from the RBI along the lines of India Post payments bank. This development follows a $1 billion fund raise by Paytm for a major play in lending & financing services.

According to Vijay Shekhar Sharma, higher distribution outreach backed by technology enabled low cost operations shall lead to a profitable growth model. If all goes as per plans the company will look to hit the bourses by 2022.

Comments

Post a Comment