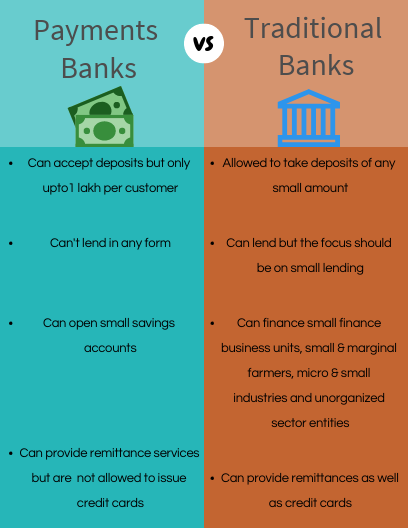

The Humble Roots : What started as a recharge services platform at an initial investment of $2 million in 2010 now commands a staggering valuation of $16 billion (Approx ₹1.15 lakh crores). The phenomenal growth story of Paytm is all set to take further strides with the company venturing into the small finance banking space. B efore we dig deeper let's understand the basic difference between traditional banks and payments bank. The Reserve Bank of India conceptualized Payments banks as a new model for banks. These banks can accept a maximum deposit of ₹1,00,000 per customer. Also, they are not authorized to advance loans or issue cred it cards. These banks primarily operate on a small scale and their main objective is to widen the spread of payment & financial services to SME's, MSME's, low income households, migrant labour workforce in secured technology driven environment. Paytm payments bank was launched in May 2017 under a restricted banking licen...